US and UK retail brand health

15 Aug 2025|3 MIN READ

US and UK Retail Brands - Summer 2025

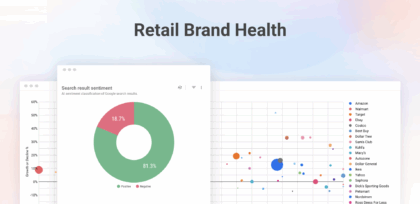

The retail industry is undergoing a constant and rapid transformation, driven by shifting consumer preferences and the ever-expanding digital landscape. This analysis delves into the critical data points that define the current state of the market in the UK and US. By examining brand sentiment, search growth trends, and overall online visibility, we can uncover key insights into which brands are thriving, which are facing challenges, and the strategic imperatives required to succeed in this competitive sector. Brand sentiment in search has emerged from the new and exciting LLM search story. At Pi, we’re exploring how brand sentiment works across SEO, AEO, and GEO use cases. The following outputs are experimental

Brand Sentiment and Growth Analysis

Executive Summary

In the Retailer sector, several brands achieve perfect sentiment scores of 100%, including Barnes & Noble and Genuine Parts in both the US and UK markets. In a notable contrast, Ross Dress For Less in the US demonstrates a significant divergence with a search growth of 46% but a negative sentiment score of -55%.

In the UK market, Lidl shows the highest search growth at 37%. For the US market, Sam's Club leads with a growth of 33%. In terms of sheer search volume, Amazon is a dominant force with 262.8 million searches in the UK, while in the US, Walmart commands 709.4 million searches.

The two most visible domains across both markets are youtube.com and wikipedia.org. This implies that a successful digital strategy in the retail sector must incorporate both video-based content for engagement and informational content to build authority and capture user interest at different stages of the buying journey.

An analysis of brand sentiment reveals a polarized landscape. A remarkable number of brands have achieved a perfect 100% positive sentiment score, including Best Buy, Barnes & Noble, and Genuine Parts in the UK, with the latter two also scoring 100% in the US. This indicates highly effective reputation management and customer satisfaction. Whole Foods also maintains strong positive sentiment in both the UK (92%) and US (79%).

However, some brands face significant sentiment challenges. In the UK, Wolverine World Wide registered a deeply negative sentiment of -85%, while Ross Dress For Less scored -51%. The situation for Ross Dress For Less is particularly stark in the US, where its sentiment is -55% despite experiencing a massive search growth of 46%. This disconnect highlights that rising search interest does not always translate to positive brand perception, suggesting potential issues with customer experience or public relations that need addressing.

Top Brands Growth and Decline by Market

Brand sentiment and health dashboard

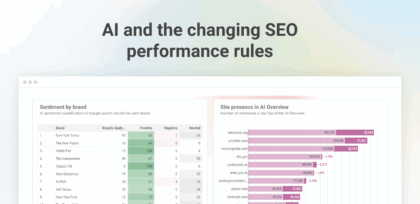

Examining search volume growth over the last 12 months reveals a clear trend towards value and discount retail. In the UK, the supermarket chain Lidl leads with an impressive 37% growth in search interest, followed by grocer Sainsbury's at 25%. Legacy brands like Amazon (262.8 million searches) and Argos (107.8 million searches) continue to dominate in total volume, though Ebay saw a decline of -7%.

In the US, this trend is even more pronounced, with Sam's Club and Dollar Tree both recording a 33% increase in search growth. E-commerce and big-box giants maintain their supremacy in search volume, led by Amazon with 1.7 billion annual searches and Walmart with 709.4 million. While most major retailers show stable or positive growth, department store Macy's experienced a search decline of -4%, indicating potential shifts in consumer shopping habits away from traditional models.

Top Domain Visibility by Market

Brand sentiment and health dashboard

The domain visibility data underscores the importance of a diversified online presence beyond a brand's own website. In both the UK and US, youtube.com and wikipedia.org are the most visible domains. YouTube's dominance (650 visibility score in the US, 524 in the UK) signals the critical role of video content, such as reviews, tutorials, and brand storytelling. Wikipedia's high ranking (565 in the UK, 496 in the US) highlights that consumers are actively seeking neutral, informational content about brands and products.

Social media platforms, including facebook.com, instagram.com, x.com, and reddit.com, also feature prominently in both markets. Their strong visibility indicates that conversations shaping brand perception are happening across these channels, making social listening and engagement essential components of any comprehensive retail strategy.

Final Thoughts on the Retailer Landscape

The data paints a clear picture of the modern retail environment: a field dominated by digital marketplaces but with significant opportunities for value-driven brands. The success of retailers like Lidl, Sam's Club, and Dollar Tree demonstrates a strong consumer appetite for affordability. However, the cautionary tale of brands with high search growth but low sentiment proves that popularity is not a substitute for a positive customer experience. To win, retailers must build a robust, multi-channel digital strategy that leverages high-visibility platforms like YouTube for engagement and manages brand conversations across the social web, all while delivering on core customer expectations of value and service.

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.