Winners and Losers in retail: Causation or correlation?

02 Nov 2017|3 MIN READ

We know that there’s not one single route to success in retail.

Many factors can influence a purchase:

- Variety of choice

- Ease of delivery

- Strength of strategy

- Etc.

But, there’s no denying that share of voice in Google plays a huge part in determining, not just success, but futureproofed success.

So which CEO’s look at organic performance as one of their KPIs? We can clearly identify a few, but not all.

Who’s winning in fashion retail?

Based on our Market Intelligence reports, Asos - who recently reported a 16% YoY online profit increase in the UK - is performing top in the retail fashion industry.

On the other side of the coin, brands seeing sliding profits are nowhere to be seen.

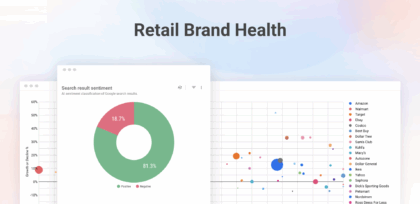

We've taken a look at a recent snapshot of the entire retail fashion landscape (25k+ sites), based on the highest value searches.

The fashion landscape: Who’s performing?

Supermarkets, marketplaces, sportswear retailers, and even niche players with only one vertical, such as H.Samuel (jewellers) and Clarks (shoes), all appear in this space: a space which is prime for fashion retail sites given the searches included and analyzed.

Womenswear share of voice

The same players also appear to be owning gender specific terms across the ‘Womenswear’ sector - the most Organically Valuable fashion retail category.

Strong performance in search indicates strong performance in business

The following sites…

- Asos (The fashion landscape: position 1)

- Boohoo (The fashion landscape: position 4)

- Pretty Little Thing (The fashion landscape: position 8 - acquired by Boohoo in 2016)

- Missguided (The fashion landscape: position 13)

… have all experienced significant commercial success over the last year:

- Asos: Revenue up 33% (£1.88bn), pre-tax profits up 145% (£80m)

- Boohoo: Revenue up 51% (£294m), pre-tax profit up 97% (£30.9 m)

- Missguided: Revenue up 75% (£206m), with “Strong underlying profit growth”

What do the winners have in common?

The retailers that do well use data - and search data in particular - to know both their customer, and their customer’s intent.

With this insight, they are able to:

- Advertise in the right place at the right time

- Build a content strategy based on search trends

- Innovate digitally to develop seamless ecommerce

- Embrace relevant new partnerships and opportunities

These winners put customer intent and search at the start of their strategy.

They fuel their organisation with data and make decisions based on measurable insight.

Traditional retailers are realising the value in search data

Admittedly, one caveat of the ‘Winners win through digital’ theory, is that retailers like Asos originated online. Their strategy is, and always has been ‘Digital-first’, so they have had a head start.

By foregoing offline retail, they don’t incur any of the costs or overheads that a high street retailer does. So, arguably, it makes sense that they’re seeing stronger online profits.

But, if we look back at the organic search snapshot above, it’s clear that plenty of traditional high street retailers are managing to make the successful transition to digital and omnichannel.

Debenhams

Founded in 1778 in Central London, Debenhams is the quintessential British high street retailer.

But, to survive in a hugely competitive market, Debenhams is putting tradition aside to truly embrace digital.

With the appointment of CEO, Sergio Bucher, in 2016 (the former European Fashion Vice President of ecommerce leviathan: Amazon) it didn’t take much for us to imagine what was in store for Debenhams in the way of digital.

Currently, Debenhams commands the second highest share of voice (out of a vast 25k+ sites) in fashion retail across organic search.

‘Debenhams redesigned’

Bucher announced a mobile-led ‘Turnaround strategy’ earlier this year, with the initiative to develop ecommerce and become a leader in social shopping.

In the first half of the year, online sales have already grown by 14.6%, with the UK up by 12%.

H. Samuel

In share of voice terms, H. Samuel shows strong performance in the fashion retail sector (position 7 out of a possible 25k+ sites).

Their digital incentive is also strong. In fact, the organisation is restructuring its entire executive board to support a multi-channel, customer-first strategy, and is investing substantial amounts in digital marketing - most notably: search.

“Our digital marketing and online presence is more pronounced than ever, and we are continuing to invest in and direct more resources to improve the key elements of the overall customer digital journey.”

Seb Hobbs

Signet Jewelers President +

Chief Customer Officer

Winners and losers in retail: Causation or correlation?

With the death of the highstreet, and the boom of ecommerce, is it just a big coincidence that the brands losing revenue and profits are also the ones with a looser grasp on digital and their search market share online?

Organisations seeing data as value, and powering every department with search insight are the ones dominating their industry right now.

The rise of marketplaces and ‘Borderless sectors’ means competition in retail is cut-throat. It's more important now than it ever has been to adopt a search and customer intent mindset.

Spotting patterns, forecasting demand, and knowing your customers next steps is crucial to succeeding in retail, and search data is the driving force of this.

If you’re interested in seeing your online visibility within your market, get in touch to demo our Market Intelligence platform or commission a bespoke Market Intelligence report.

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.