Share of Search UK Sports Gambling 2023

26 May 2023|4 MIN READ

With over 5 billion searches a day, Google is a unique barometer of customer behaviour as well as brand performance. That’s why most major brands use the metric share of search.

From the C-suite down, Share of search can help reflect a brand’s performance and media impact against their competitors and peers. Understanding how many people search for a specific brand name versus the sector as a whole, helps executives understand whether what they are doing is actually working.

Here at the Pi Intelligence Unit we’ve put together a report for the UK sports gambling sector focussing on 11 major sports gambling providers and affiliates, and tracking their brand searches over the last 36 months in Google UK.

UK sports gambling Brands Selected:

- Bet365

- Sky Bet

- Paddy Power

- Ladbrokes

- Betfair

- Bet Victor

- William Hill

- Coral

- BetFred

- OddsChecker

- 888

Share of Search Methodology

We tracked the above brands (single term) in Pi’s Share of Voice Tool, which delivered 36 months of volume data. Together with the single term we added in additional specific services, as well as general user terms:

So it would be “brand”+ …(examples)

“Brand” + app

“Brand” + online

“Brand” + bets

“Brand” + horses

“Brand” + football

“Brand” + gambling

“Brand” + odds

“Brand” + tips

“Brand” + sign up

“Brand” + online gambling

Background of the UK online gambling market

The online gambling sector in the UK generates around £6.9bn in revenue each year (stats from 2020), and makes up 61% of all gambling. Sports betting makes up around £2.6bn of the online revenue.

The pandemic significantly affected the gambling sector in the UK. During that time sports events were cancelled and bricks and mortar stores were closed. However, since then the industry is seeing a resurgence, helped by the biggest recurring events of The Grand National and The World Cup.

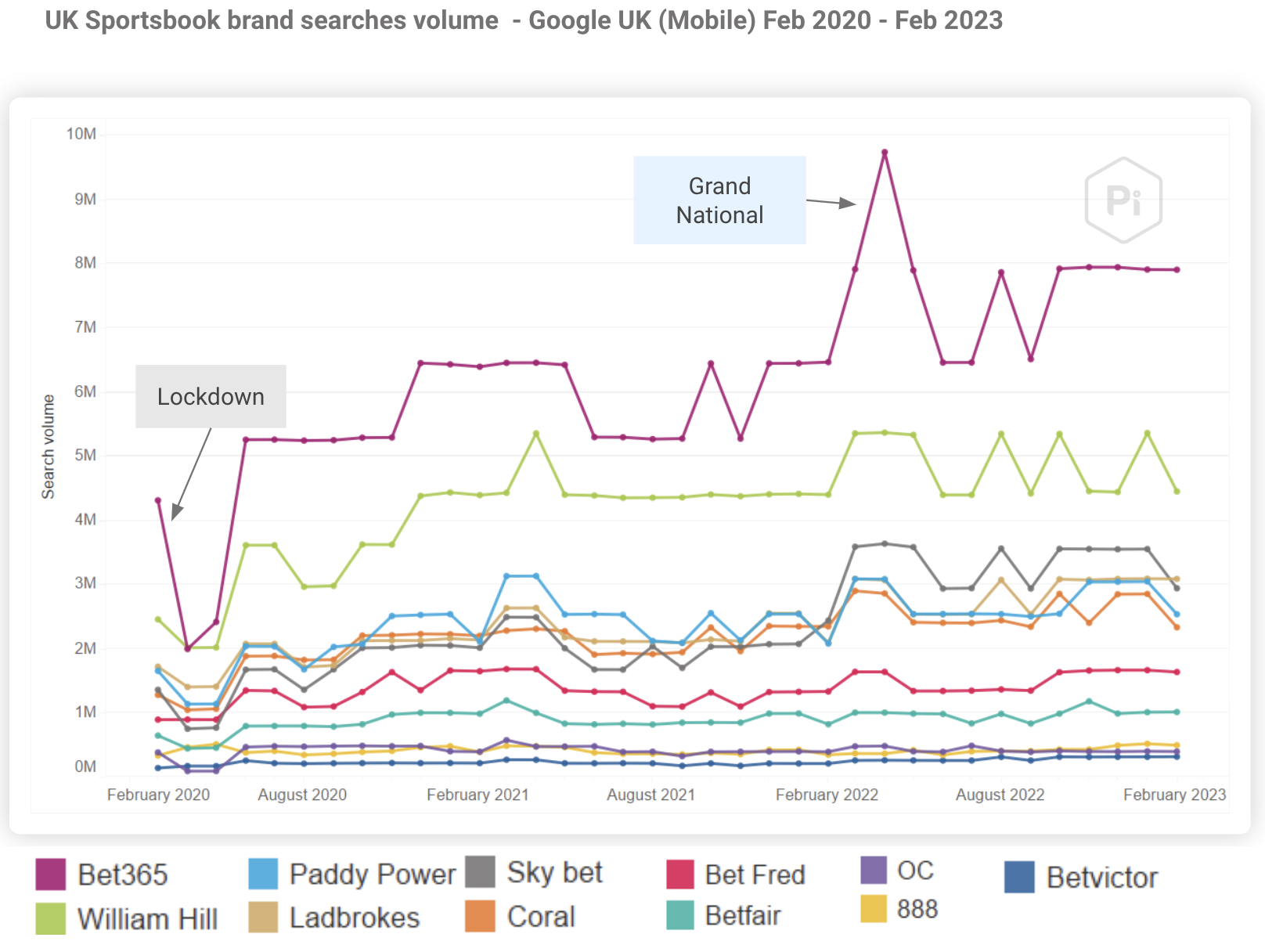

Search volume for UK sports gambling brands 36 months

We created the search term categories across the 11 brands, started tracking the results in Pi Datametrics, and collected the search volume for the previous 36 months…

Here we look at 11 of the most popular sports betting brands in the UK. Using Pi Market Intelligence we track the search volume for their brand terms over the last 36 months.

Bet365 leads for brand searches, reaching a peak of 9.74m searches per month in April 2022. William Hill shadows the leaders, until the last few months.

See the significant dip during the first lockdown of March 2020. With no sports being played demand obviously dropped, but the brands still managed to push many millions of searches between them.

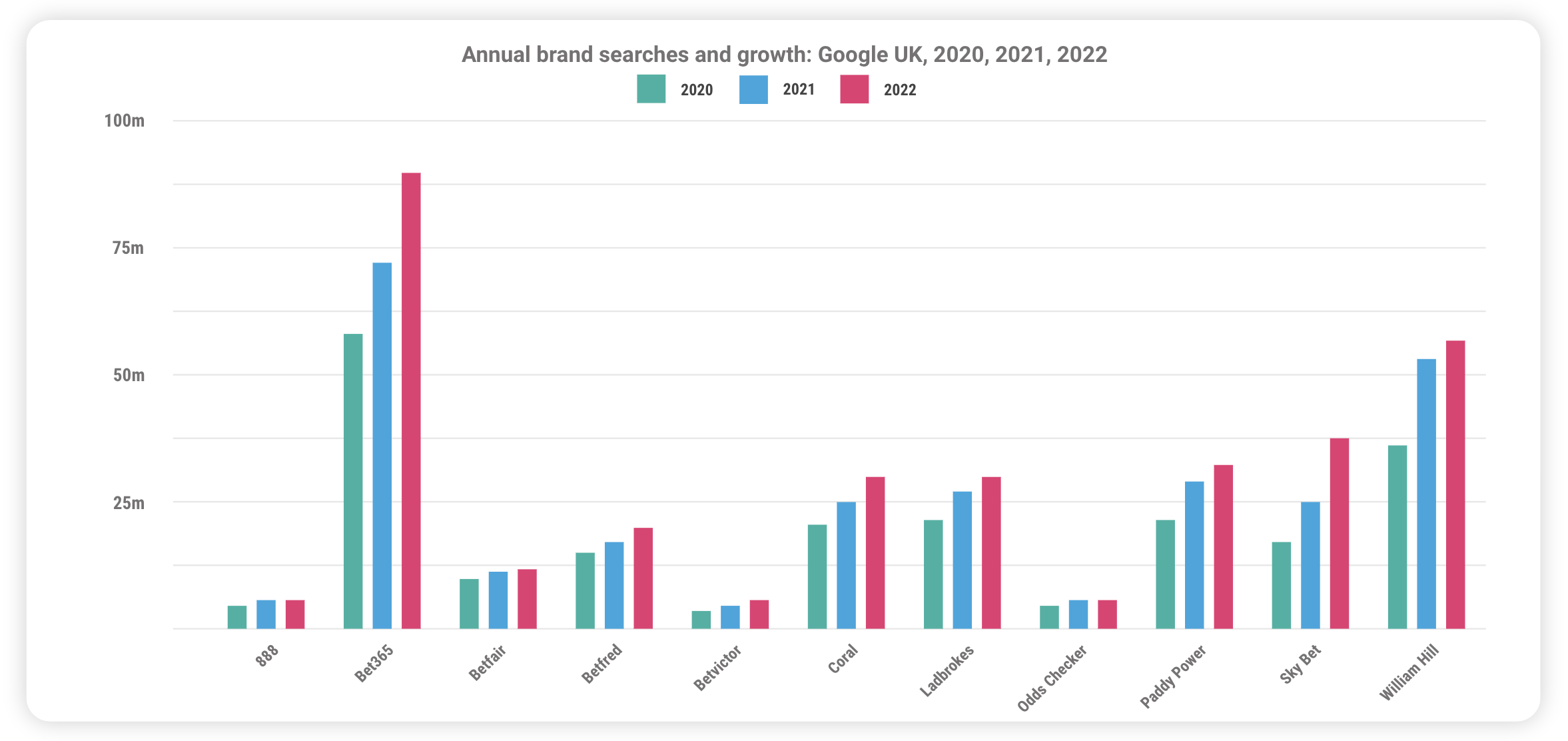

Total annual brand search volume 2020-2023 – UK Sports gambling sector

Using Pi datametrics search data, we see all of the 11 sports gambling brands are growing in search from 2020-21

By hitting over 50m brand searches per year from 2020 (with over 80m in 2022), Bet365 was a clear market leader for UK sports gambling in search. Second place is William Hill, reaching that 50m mark in 2021.

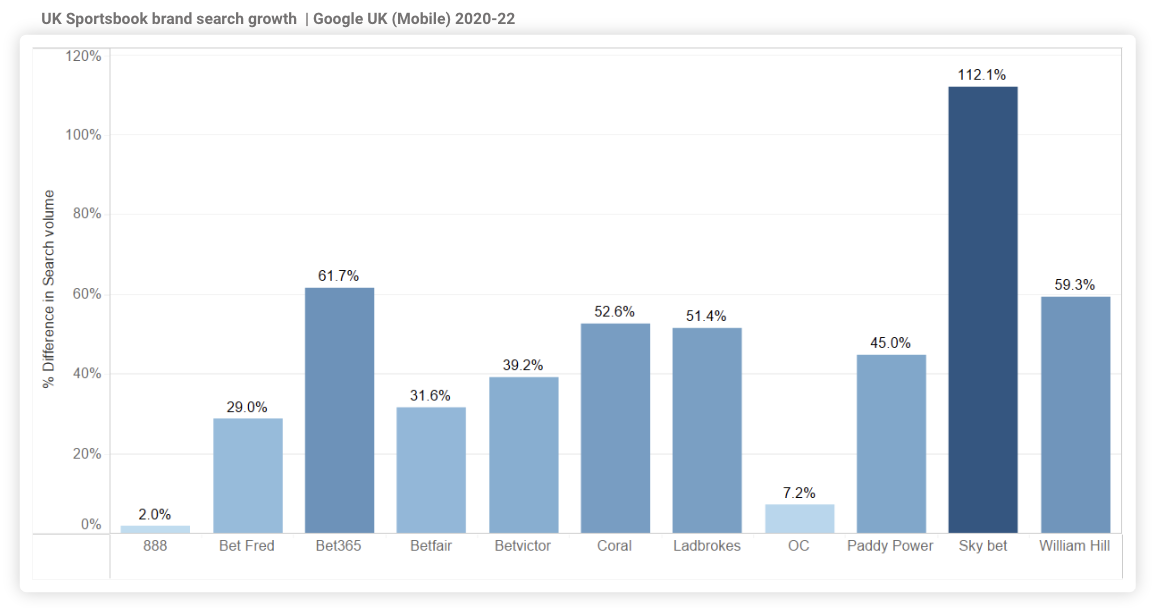

Growth and decline of search volume UK gambling market 2020-2023

Multiple brands saw impressive growth from 2020 to 2022, with many enjoying 40%+ growth rates in their brand searches.

However, the one that stands out the most is Sky Bet, which increased 112% from 2020 to 2022. Despite it already being dominant, Bet365 enjoyed a 61% increase over the same period, solidifying its number one spot.

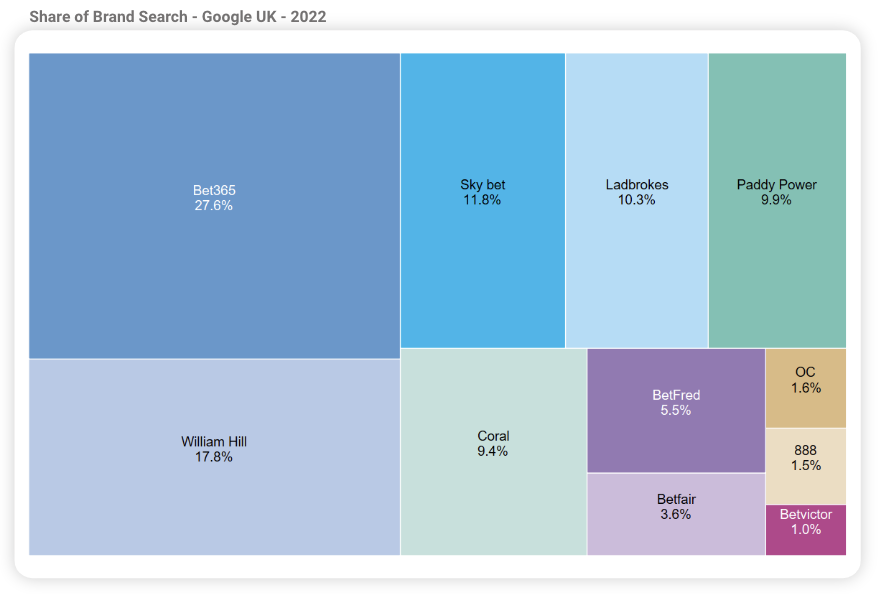

Share of Search 2022-23 UK gambling market

Based on the brand searches we included (these are the single brand term, as well as additional terms of “brand” + “XXX”) 324m searches were made in Google UK during 2022, with Bet365 accruing a share of 27.6% of this total figure.

Sky Bet’s share increased by 2.9%, then Bet365’s share increased from 2021 by 1.41% percentage points

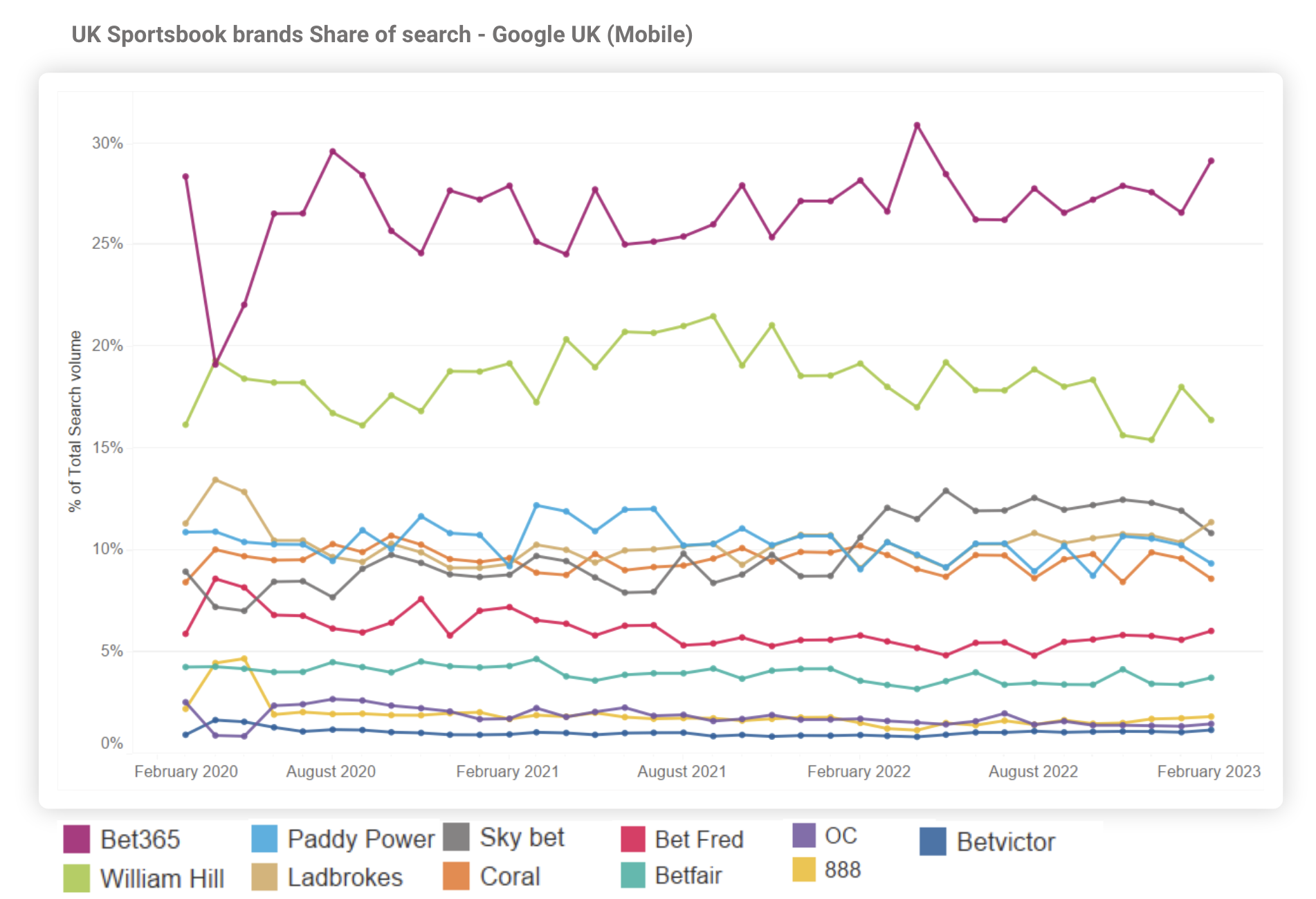

Share of UK gambling brand search timeline 2020-2023

Just before lockdown and the pandemic affecting major sporting events in 2020, William Hill and Bet365 were neck and neck in terms of brand share of search for the sports gambling sector.

However, from that point onwards, Bet365 pulled away and is now several furlongs ahead of the chasing pack.

“Sky Bet” – brand search uplift 2020-2022, versus “Skybet”

For the purpose of this report, we have only used one brand name (based on spaces or derivatives of a brand.) Previously within Google this wasn’t an issue. Since 2021, Google changed this, however this also coincided with Flutter’s acquisition of Sky Bet, with impressive growth since then.

For “SkyBet” we see a decline from late 2021 onwards. Though for “Sky Bet” there is impressive growth. This also coincided with Flutter’s acquisition of the brand and group. Showing almost immediate, and significant gains within the market.

Additionally, Sky Bet’s overall SEO is very good, performing 3rd in the non-branded table with a Share of Voice of 6%.

For a fuller view of our UK gambling sports sector report, including share of search as well as SEO share of voice, download the report or get in touch with info@pi-datametrics.com.

UK Gambling: Share of search and growth report

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.