UK Insurance sector share of brand search 2023

26 May 2023|4 MIN READ

Share of search is a metric to help define a brand’s performance and media impact. How many people search for a specific brand name (maybe after seeing an advertisement or a promotion) is used by marketing performance executives up to the C-suite to ascertain whether spend is impacting market share.

So, here at the Pi Intelligence Unit we’ve put together a report for the UK insurance sector focussing on 12 major insurance providers and comparison sites, and tracking their brand searches over the last 36 months in Google UK.

UK Insurance Brands Selected:

- Admiral

- LV

- Compare The Market

- Go Compare

- Hastings Direct

- Esure

- Direct Line

- Aviva

- Axa

- MoneySupermarket

- Confused

- Legal and General

Share of Search Methodology

We tracked the above brands (single term) in Pi datametrics SEO platform, which delivered 36 months of volume data. Together with the single term we added in additional specific services, as well as general user terms:

So it would be “brand”+ …

- “Brand” + insurance

- “Brand” + car insurance

- “Brand” + log-in

- “Brand” + travel insurance

- “Brand” + health insurance

- “Brand” + home insurance

- “Brand” + claim

- “Brand” + business insurance

- “Brand” + app

Background of the UK Insurance market

The UK insurance sector is the biggest in Europe and the 4th largest in the world. It contributes over £16bn to the UK economy in taxes and over 320,000 people are employed in the sector. In short, it’s big, lucrative and therefore extremely competitive. Most of us need insurance (68% of us have car insurance, 69% have contents) and most of us need to purchase new products relatively regularly. So the prominence of the brands within the sector and their relative media coverage is key to gaining market share for products which are ultimately intangible.

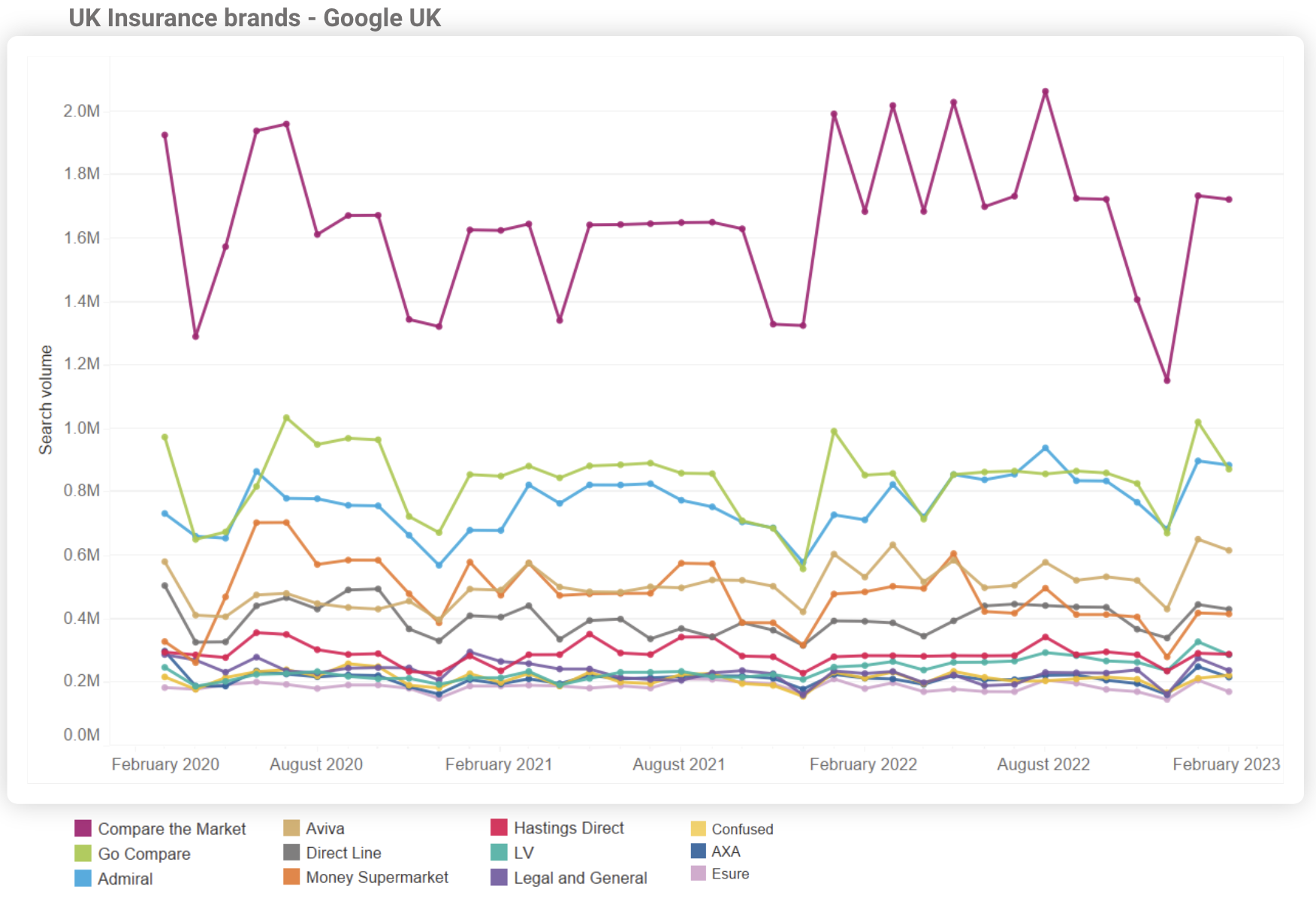

Search volume for UK Insurance brands 36 months

We put together the above search terms into collective categories across the 12 brands and collected the search volume for the previous 36 months…

Compare The Market dominates brand searches in the UK Insurance market, with Gocompare and Admiral in 2nd and 3rd.

Whereas Compare the Market hits 2m monthly searches on occasion and Go Compare hitting 1m, most other brands are hovering between 200k and 600k monthly searches.

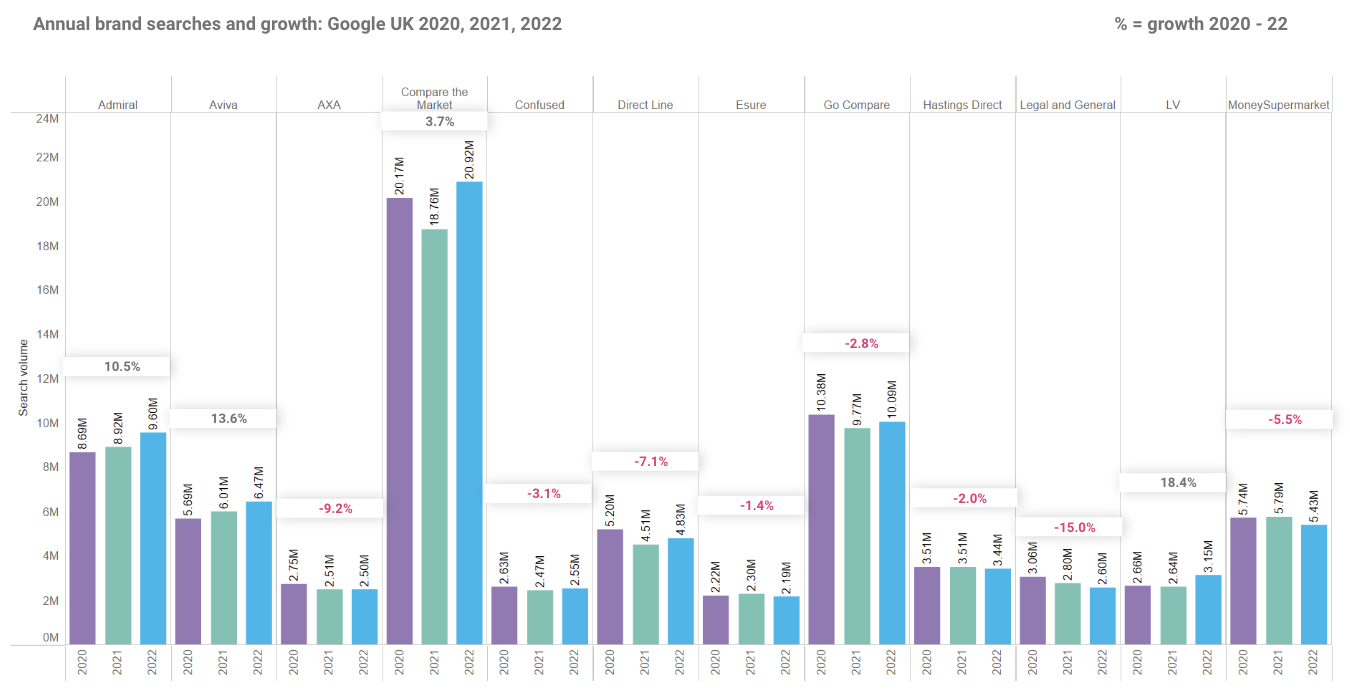

Total annual search volume 2020-2022 – UK insurance sector

Above are 12 of the largest insurance providers and comparison sites’ brand search volume and growth

By hitting around 20m searches a year from 2020 to 2022, Compare the Market was a clear market leader for UK insurance in search. Second place is Go Compare which attracted around half the amount of its competitor comparison site.

Despite it already being dominant, Compare The Market enjoyed a 4% increase over the same period, galvanising its number one spot. Admiral, Aviva and LV all saw a double digit percentage growth in searches over the period.

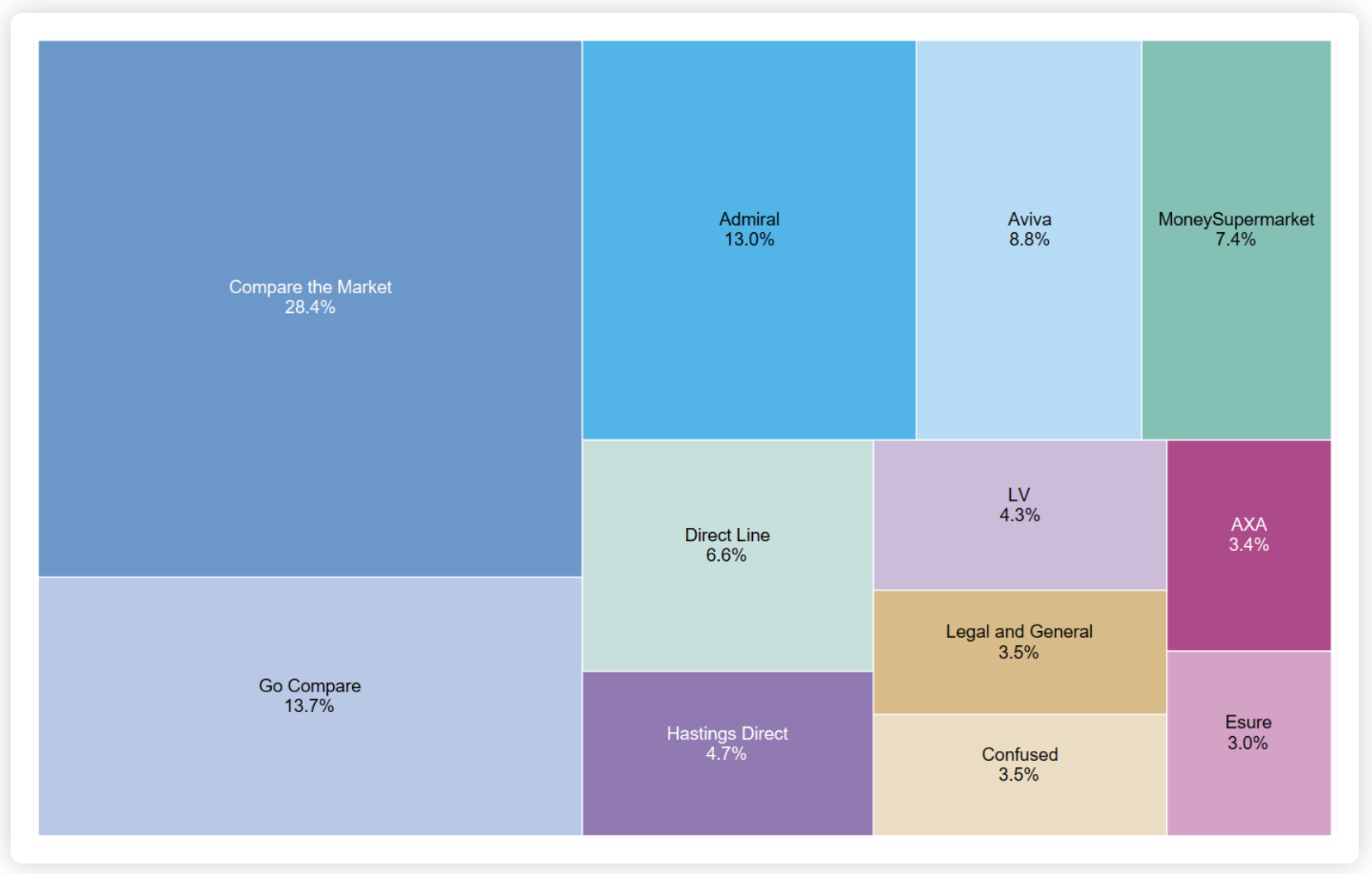

Share of Search 2022-23 UK Insurance market

As you can see comparison sites dominate share of brand searches (comparison sites don’t actually sell their own insurance packages, but refer the customer to the best available deals from their partners).

The data above shows share of brands’ performance across 73m searches in Google UK for 2022. With relative dominance of these comparison sites, is it correct to assume that the UK consumer cares more about cost than about which brand when it comes to purchasing insurance products?

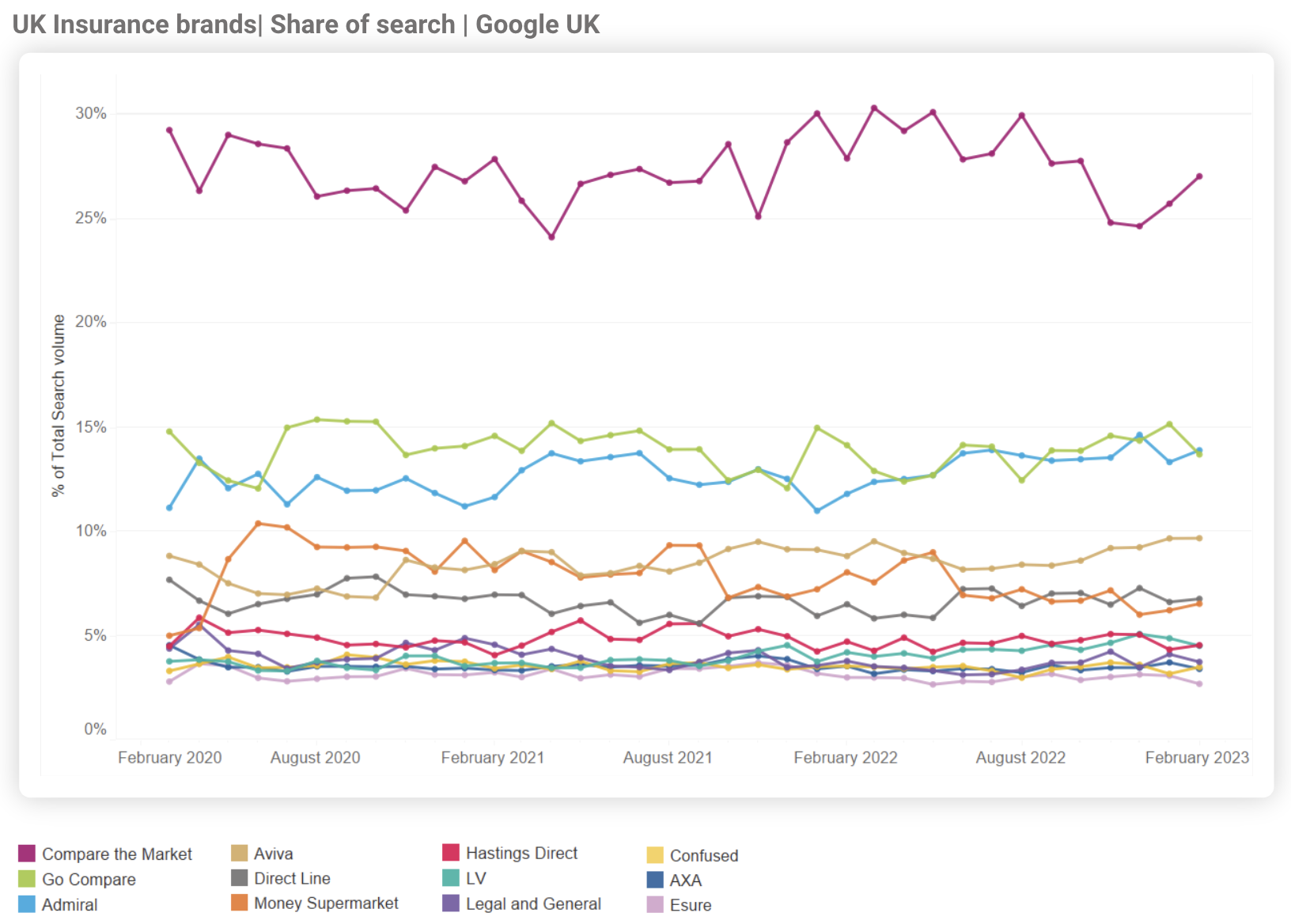

Share of UK insurance brand search timeline 2020-2023

Compare The Market’s share of brand has remained dominant throughout the previous 36 months.

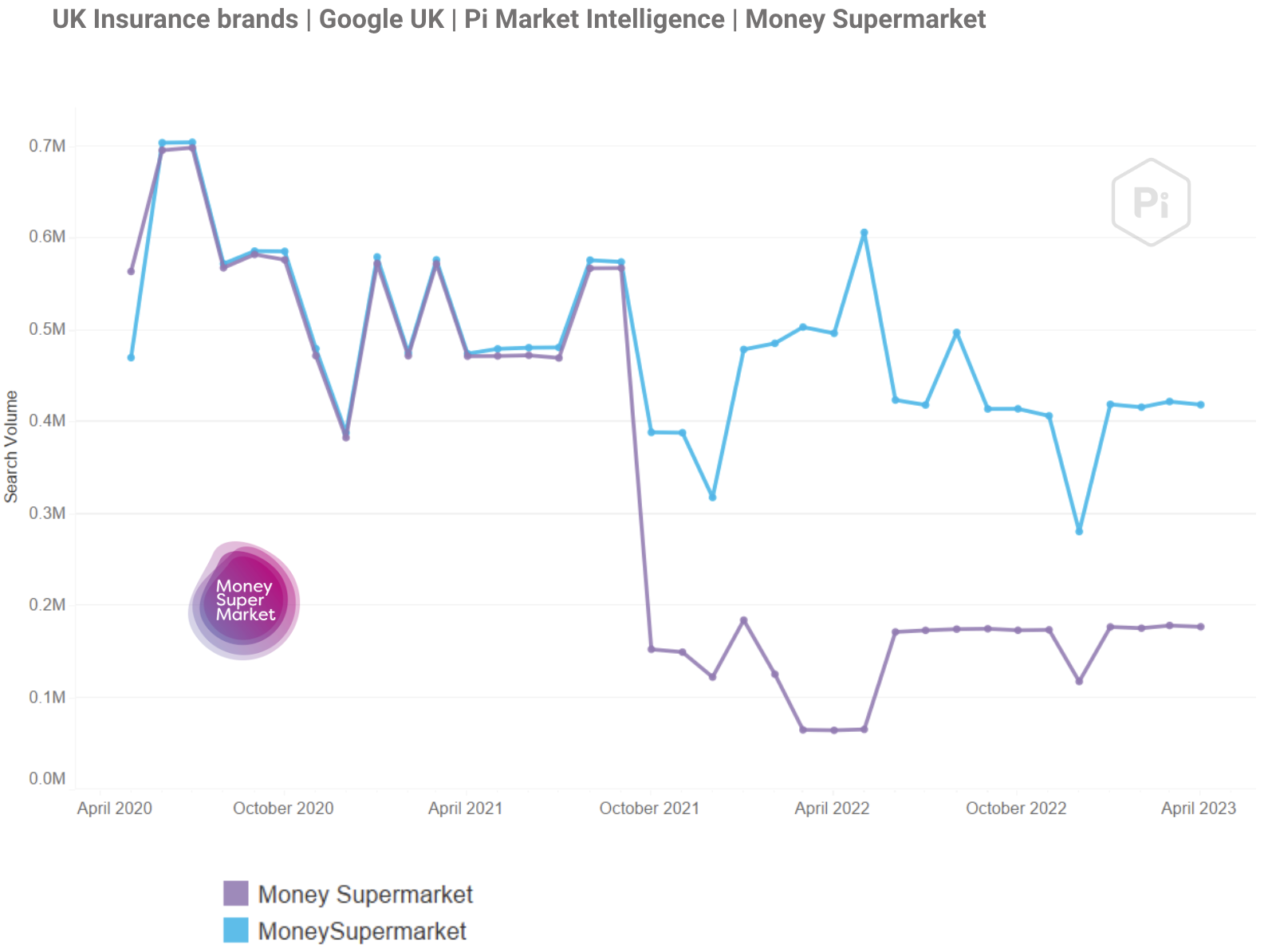

Analysing brand searches: “MoneySupermarket” vs “Money Supermarket”

For this report we have looked at one version of a name for each brand, despite some having multiple derivatives.

Previously Google would combine the volume for many of these derivatives, however this changed in 2021, as you see for the example here for Money Supermarket v Moneysupermarket.

Moneysupermarket’s overall SEO is very good, performing 2nd in SOV with 12.5% share (see content section).

For a fuller view of our UK Insurance sector report, including share of search as well as SEO share of voice, download the report.

UK Insurance: Share of search and growth report

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.