Alternative data | What is alternative data?

11 Jun 2019|3 MIN READ

What is alternative data?

Alternative data refers to insight that’s aggregated from various, unconventional sources.

It is sometimes referred to as ‘Digital exhaust’, as it’s primarily spawned by online activities, including: internet searches, social media posts, consumer transactions, online bookings, location trails and so on. As of July 2017, a total of 482 datasets were identified across 24 different categories.

Data gatekeepers harvest these kinds of insights to illuminate consumer behaviour and market trends, which can inform strategy across numerous industry verticals.

Alternative data reveals intelligence that would otherwise be overlooked in traditional methods of data analysis.

Alternative data can come in many different forms and guises:

- Web data

- Search data

- Social data

- Pricing data

- Weather data

- Geo-location data

- Image data

- Public record data

- Consumer transaction data

- Satellite data

"The data revolution, spurred by the internet, has closed the information gap in investing. Now anyone with an internet connection can access all the data that used to be the purview of professional investors. Big data reveals digital traces of human behavior. [It can] take a variety of forms — text, search data, social media, images, and video, among them — and can provide investors with insight into alpha-generating market inefficiencies or potentially leading indicators that get them ahead of consumer sentiment."

CFA Institute

CFA InstituteReferences:

- CFA Institute

- Paul McCaffrey, 2018

What is alternative data in finance?

In the context of finance, alternative data refers to information pertaining to or surrounding a specific company that is aggregated by sources external to that company.

This is most commonly used by hedge funds or M&A teams seeking alpha, to illuminate novel and timely investment opportunities.

This is also often referred to as Collective Intelligence Investing:

"As some Investment Managers increase their use of alternative data sources, they are looking to the wisdom of the crowd for potential alpha advantage. We refer to this process of generating market insights from online communities and crowdsourcing platforms as collective intelligence investing."

Deloitte

DeloitteReferences:

- Deloitte Center for Financial Services, 2018.

Alternative data is being used more than ever before in finance. In fact, web scraping for investment insight has become so commonplace that 5% of all internet traffic in 2018 was a result of Hedge Funds scraping the web for data.

The use of alternative data in finance isn’t a new phenomenon. The MarketPsy Long-Short Fund, first began feeding social media sentiment data into its investment models as far back as 2008.

How is alternative data used to inform business strategy?

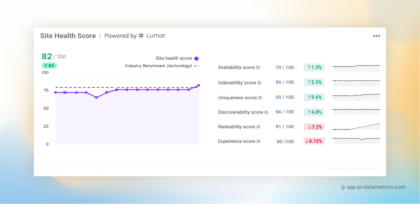

At Pi, we work alongside Investment Managers to inform trading decisions with the largely untapped source: search data. This top-level behaviour and market insight has enabled:

Lucrative offline investments in brick & mortar retail

Investment Analysts of a global shopping centre use search as alt data to study 971 emerging and established UK fashion retailers, across 6.2bn historical searches over the course of three years.

In conjunction with this insight, they dive into fashion trends across numerous sartorial categories, with the aim to make more informed decisions on which stores and pop-up outlets to rent retail space to.

Acquisitions of market-leader holding companies in gambling

The M&A team of Global Mobile Gaming company, LeoVegas, used search data to assess the value of the UK gambling landscape across 67k sites, 4k search terms and 13m searches. Using this insight as a source of alternative data, LeoVegas reinforced the decision to acquire the UKs largest gambling holding company; made up of 18 brands.

Global valuation modelling within Hedge Funds

A global Hedge Fund, with offices in New York and London, uses Pi’s search intelligence data to help it evaluate the online assets of retailers across the UK and US, and beyond.

Using both historic and real-time data, it analyses online performance as one of the many indicators of overall stock performance. Along with Pi’s daily value updates, the Analysts feed these indicators back to their Portfolio Managers.

What is the best source of alternative data?

Alternative data is vital for providing deeper insight into industries, competitors and customers.

And the signals proffered by search are some of the most comprehensive of all alternative datasets.

Why? Because they pose a triple threat:

Scale:The scope of search data is vast. We search up to 3.5bn times a day. That’s 3.5bn potentially lucrative consumer behaviour and business insights.

Speed: We search every second of every day. Web data is therefore by far the most instantaneous way of getting to grips with a market, competitor or customer.

Subject: We search for a multiplicity of reasons. This direct source of market research intelligence has relevance to departments the business over.

Equally, with the growing importance of data protection and the advent of GDPR, aggregated search data can provide an appealing alternative to sensitive, personally identifiable data.

What are the benefits of using alternative datasets?

Unlike traditional sources of intelligence, which are often limited in their insight, alternative data is processed by enterprise software to provide big, historic datasets.

This scale of intelligence can reveal entirely unique market insights, which provide significant information and ROI advantage.

"[Alternative datasets] are able to support forecasts on a two-year or four-year time horizon, not just next quarter’s earnings call."

Hedgeweek

HedgeweekAlternative datasets are frequently viewed in tandem; facilitating pattern identification, and elucidating insights that could otherwise have not been gleaned with a single traditional dataset.

Sourced externally to the business, alt data also arguably fosters truer insight and objectivity than traditional datasets, which are often produced by the company itself.

How do you extract insight from alternative datasets?

Alternative insights can be found in subsets of big data, but locating these signals can prove a mean feat. Choosing the right data vendors to structure this insight is imperative.

Merging this insight with your primary data is often made possible through API’s - a software intermediary that allows two applications to talk to one another.

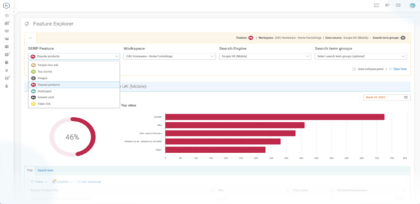

At Pi, we’ve built a search API to cede our alternative search intelligence out to wider businesses, enabling them to view and process alt data native in their own applications.

Integrating alternative datasets, to study congruent signals and lucrative insights can also be made possible through data visualisation and business intelligence software like Vizia, which showcase a number of alt data sources in a single dashboard.

What is the opportunity in alternative data?

While alternative data can at times be difficult to dissect or compute, the risk of not turning to these kinds of datasets for informing strategy is losing out on green-field opportunities; ones that, in time, may be explored by competitors.

With more and more unconventional data sources emerging, this insight is becoming vital to the success of businesses, and JP Morgan now estimates that $2 - $3 billion is being spent by asset managers on alternative data (2017).

With the proliferation of crowd-sourced intelligence, and rapid adoption, the time to feed alternative datasets into your strategy is now.

To begin using alternative search data as part of your business strategy, Get Started Here.

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.

Never miss a post

Join our mailing list and have our SEO news delivered straight to your inbox.